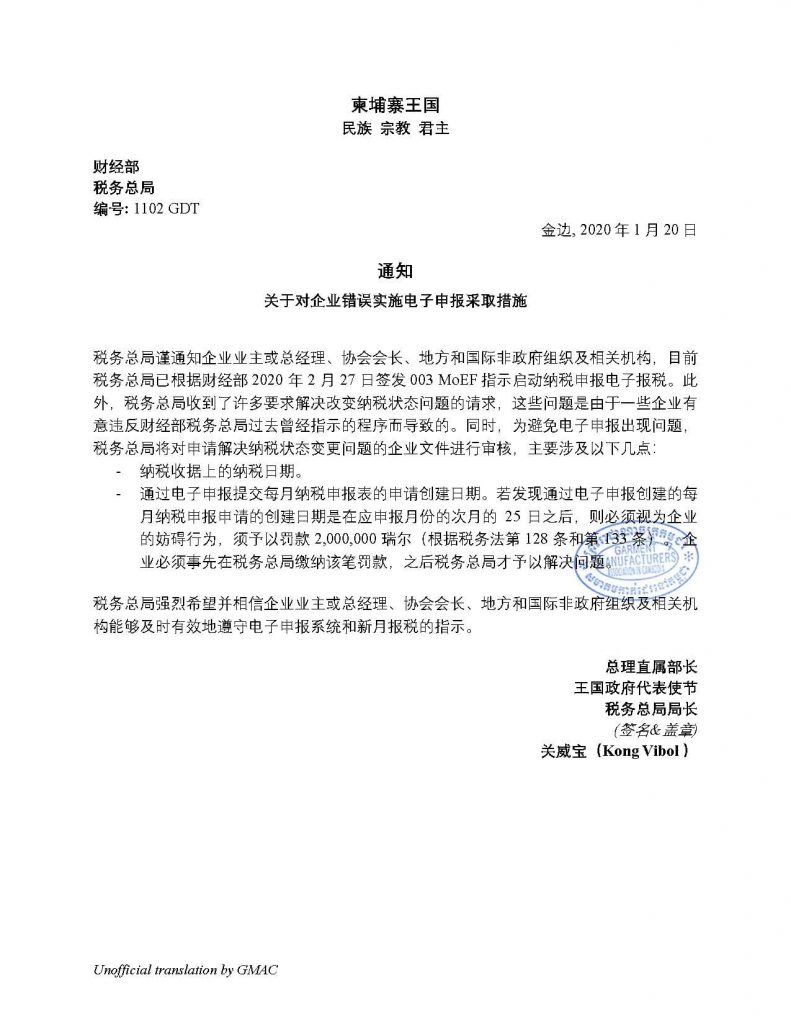

អគ្គនាយកដ្ឋានពន្ធដារបានចេញសេចក្តីជូនដំណឹងស្ដីពីការអនុវត្តវិធានការលើសហគ្រាសដែលអនុវត្តខុសពីនីតិវិធីនៃការប្រើប្រាស់ប្រព័ន្ធគ្រប់គ្រងការដាក់លិខិតប្រកាសពន្ធតាមអនឡាញ (E-Filing) The General Department of Taxation has issued a Notification on Measures Against Enterprises Wrongly Implementing E-Filing.

The General Department of Taxation would like to inform directors or owners of enterprises, presidents of associations, local and international non-governmental organizations and relevant institutions that so far the General Department of Taxation has launched E-Filing for filing tax returns in accordance with Instruction 003 MEF dated 27 February 2020 of the Ministry of Economy and Finance on E-Filing System and New Monthly Tax Return. In addition, the General Department of Taxation has received requests for resolving many issues of changing the status of paying tax and these issues resulted from some enterprises having the intention of carrying out against the procedure that the General Department of Taxation of the Ministry of Economy and Finance has instructed so far. Meanwhile, to avoid issues concerning the filing of tax returns via E-Filing, the General Department of Taxation will take action to review documents of any enterprises that make a request for resolving the issue of changing the status of tax payment concerning the following points:

- Date of tax payment in the tax payment receipt.

- Date of creation of application for paying and filing monthly tax return via the E- Filing. When seeing that the date of creation of application for paying and filing the E-Filing is after the 25″ of the following month of the due month, it act of obstruction which the enterprise is subject to a fine of 2,000,000 Riels and Article 133 of the Law on Taxation).

The General Department of Taxation strongly hopes and believes that directors or owners of enterprises, presidents of associations, local and international non-governmental organizations and relevant institutions will duly comply with the Instruction on E-Filing System and New Monthly Tax Return in a highly effective manner.

Source: GMAC

Leave a Reply

You must be logged in to post a comment.