What is a Certificate of Origin?

A certificate of origin (CO) is a document used in international trade to certify goods made in the country from which they are exported from.

A CO is completed by the exporter and certified by a recognized issuing body – in the Kingdom of Cambodia’s case, Ministry of Commerce (MOC), attesting that the goods in a particular export shipment have been produced, manufactured or processed in a particular country.

Preferential and Non-preferential Cos

Non-preferential COs see goods that do not benefit from any preferential treatment and do not emanate from bilateral or multilateral free trade agreements (FTA).

Preferential COs attest that goods in a particular shipment are of a certain origin under the definitions of a particular bilateral or multilateral FTA.

Cambodia issues various different types of Preferential Tariff Certificate of Origin:

General System of Preferences (LDC and LLDC): Certificate of Origin form A

Non-Preferential Tariff: Can be issued using Certificate of Origin form N

What is the GSP?

The US GSP, is the largest and oldest U.S trade program that designed to promote economic growth and provide preferential duty-free treatment for certain U.S imports from eligible developing countries.

What is the GSP’s purpose?

The congress created GSP to spur economic development in poor countries through trade and enable developing countries to diversify their economies and grow through trade.

When did the U.S GSP program begin?

The GSP program, first authorized by the Trade Act of 1974, instituted on January 1, 1976, expired on December 31 ,2017. On March 23 , 2018 the President signed legislation authorizing the GSP program through December 31 ,2020, retroactive to January 1 ,2018.

Is GSP permanent or expire?

GSP was first authorized for 10 years until 1985. Since then, it has been reauthorized 14 times with authorization generally lasting 2 to 3years.

How many countries are GSP beneficiaries?

As of December 2020, under the GSP program, there were 119 developing countries including 17 non-independent territories and 44 LDBDCs.

Are all developing countries automatically include in the GSP program?

Beneficiary developing countries are selected by the President on the basis and consideration on the certain eligibility criteria based on the country’s level of economic development and the level of how the country providing protection of poverty rights, etc.

Are all products eligible for GSP duty-free status?

The program currently cover over 3,500 products from BDCs, and additional 1,500 products from LDBDCs.

Is GSP permanent or expire?

GSP was first authorized for 10 years until 1985. Since then, it has been reauthorized 14 times with authorization generally lasting 2 to 3years.

Which imports into the United States qualify for duty-free treatment under the GSP?

must be include in the list of GSP-eligible products

must be imported directly from a BDC (the BDC must be eligible for GSP treatment for that product)

products must be the growth, product or manufacture from a BDC and meet the value added requirements

importer must request duty-free treatment under GSP by placing SPI (A, A+ or A*) before the HTSUS number that identified the imported product on the shipping documents

Which product are eligible for duty-free treatment?

Products which classified by CBP approximately 3,500 8-digit tariff rate lines from BDCs and 1,500 products from LDBDCs. The combined GSP-eligible products lists include, most dutiable manufactured (duty must be paid goods), semi-manufactured (not completely assemble goods), and selected agricultural, fishery, and primary industrial products that are not other duty-free.

products that identified in the HTSUS by CBP and published by USITC

The US tariff schedule is divided into almost 100 chapters which group by product type.

*some products are prohibited by law to receive GSP treatment including most textiles and apparel, watches, footwear, handbags, luggage, flat goods, work gloves, leather apparel, sensitive steel, glass, and electronic articles.

How is article identified as GSP-eligible in the HTSUS?

- ‘A’ : identifies that the product is GSP-eligible from all BDCs

- ‘A+’ : indicates that the product is eligible only from LDBDCs

- ‘A*’ : indicates that the product is not eligible, denied duty-free treatment or lost its GSP-eligible from one or more specific BDCs

CAMBODIA’S GSP

- Cambodia became a GSP’s member country on August 01, 1997 as the beneficiary developing country (BDC) also the least developed beneficiary developing country (LDBDCs).

- Approximately 1,500 articles are added to received preferential duty-free treatment for LDBDCs also for Cambodia.

- The export to US for duty-free tariff rate of Cambodian-made travel goods (leather suitcases, handbags, backpacks) – started on July 01, 2016.

What are the rules of origin requirement?

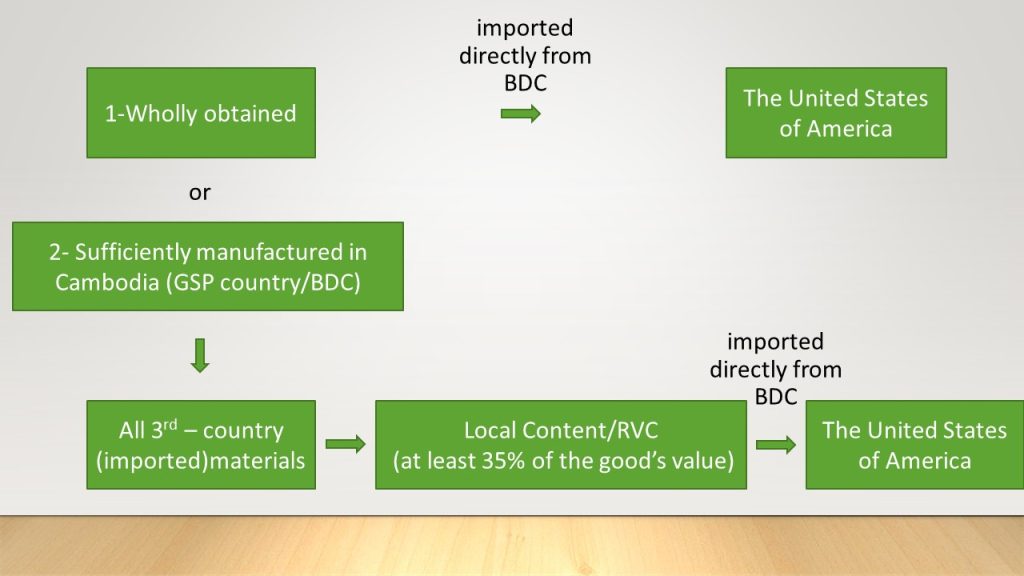

Cambodia must be eligible for GSP treatment for that article

GSP-eligible articles must be imported into the U.S directly from Cambodia

The article must be grow, produce or manufacture from Cambodia and meet the value requirement when inputs are imported from elsewhere( third-country materials)

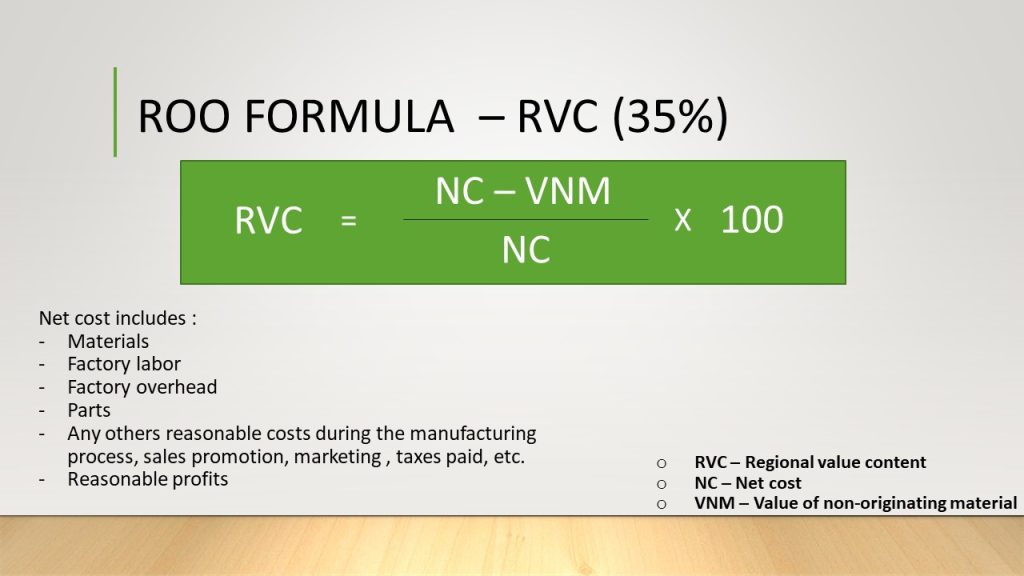

The sum of the cost or value of materials produced in Cambodia plus direct costs of processing must equal at least 35% of the product’s appraised value.

*If the imported materials undergoes a double substantial transformation (transformed in to a new and different constituent material with a new name , character and use, they will be treat as single-country inputs.

What document are needed to ensure GSP duty-free treatment?

The document that CBP may request on a case by care basis and type of documents that should be available to establish for a GSP claim are:

GSP declaration, Bill of materials, Invoices, Factory profile, Purchase orders, Production records kept in the ordinary course of business, Payroll information, Other supporting documents

**These documents must be keep for the period of 5years

What is the status of the GSP?

On December 31, 2020 – January 1, 2021 (12:00am) – the GSP program status is expired and currently pending Congressional action to pass legislation for renewal.

Effective January 1, 2021, all the goods entered the U.S are all subject to MFN duty rates (“General”, column1 in the HTSUS table )

How does an importer arrange to be reimbursed for tariffs paid during the period after the expired and before the reauthorization of GSP?

Due to delayed of legislation to reauthorized the program, buyers/importers required to pay import duties until the program is reauthorized, CBP will be enabled to automate the duty refund process for the GSP claim by the use of SPI “A” as prefix to the tariff numbers of the article at the time of entry.

- In recent years, the vast major of solar modules installed in the United Stated were imported with those from Southeast Asia making up approximately three-quarters of imported modules in 2020.

- Recently, however, the United States has been unable to import solar modules in sufficient quantities and all imported solar panels were causing serious harm to the domestic industry. In accordingly, across the country, solar projects are being postponed or canceled and the tariffs on this products add about 14% to 15% tax on the cheaper imports.

- On June 06, 2022, U.S President issued a proclamation that allow solar panels imported to the United States from four major countries, Thailand, Malaysia, Vietnam and Cambodia without risk of tariffs for a 24-month period.

- This action comes amid concern about the impact of the U.S Commerce Department’s month-long investigation into whether imports of solar panels from the four Southeast Asian nations are circumventing tariffs on goods made in China.

- U.S tariffs on solar panel from these ASEAN countries will be temporary waived, according to a White House released, June 06, 2022.

Leave a Reply

You must be logged in to post a comment.